This article is what I have compiled after reading six annual industry reports, let us review the past and look forward to the future.

2021 is the year when the metaverse and Web3 applications explode. Tom Brady featured in exchange ads while Visa bought NFTs on Ethereum.

The fear of missing out (Fear-Of-Missing-Out) is now evident in many companies in traditional finance and other industries. High Net Wealth Individuals (High Net Wealth Individuals), traditional venture capital firms, gaming companies, sports companies, etc., all of these companies are trying to catch up to the speed of Web 3.0 and determine what role they can play in this new world.

Starting with stablecoins, to mortgage lending protocols, to NFTs and games, the Web3 ecosystem now represents a broad ecosystem that, through tokenization, provides creators and communities with a new model of inter-community collaboration.

The trend of the encryption industry is optimistic for a long time: talents and capital flow to this industry

crypto.com expects the number of global cryptocurrency owners to reach 1 billion by the end of 2022. The global crypto population will increase by +178% in 2021, from 106 million in January to 295 million in December.

Major exchanges have brought virtual currency into the public eye through advertisements of four major ball games. The overall adoption growth rate in the second half of 2021 is 37.5%, which is 13% higher than that in the same period in 2020 (33.3%), indicating that the adoption rate Speed up the same period last year.

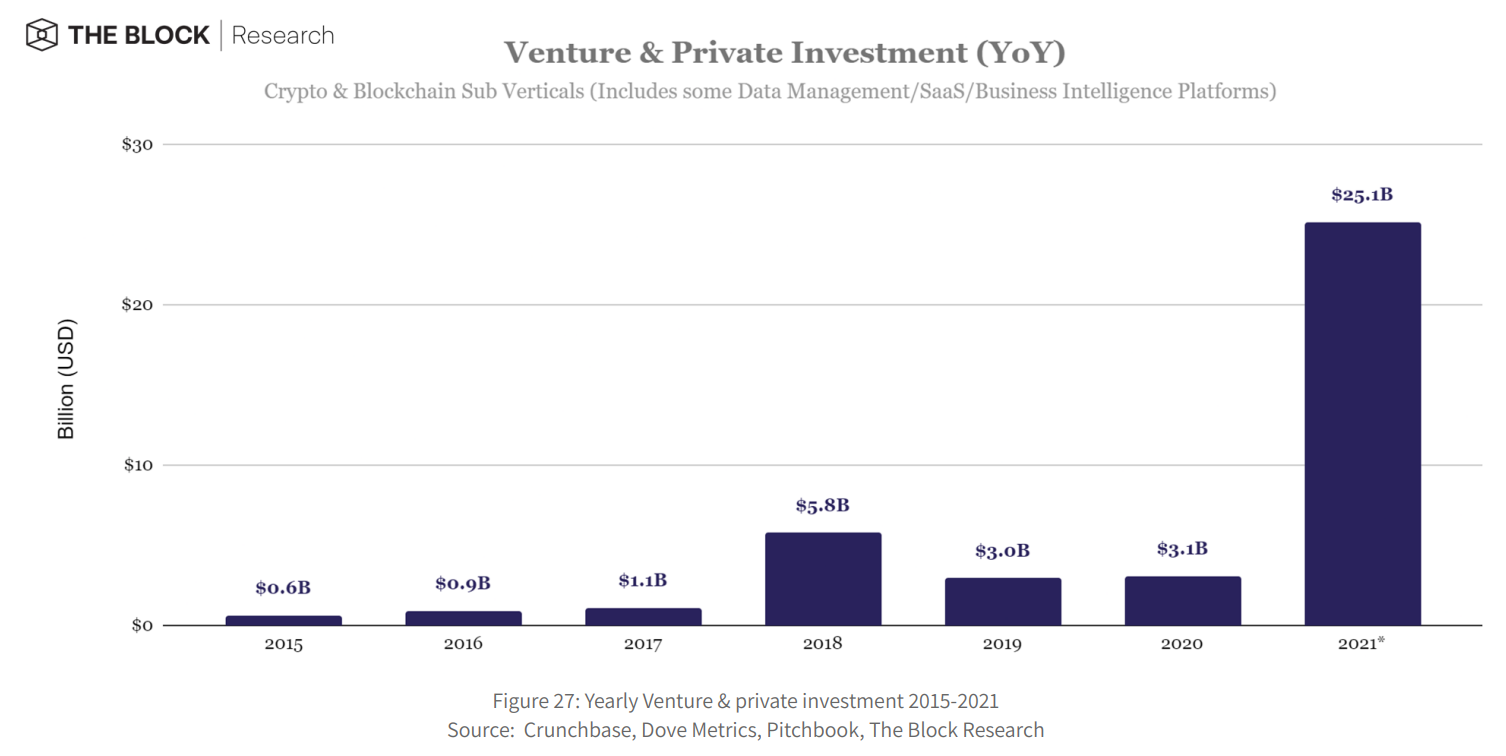

In the last year, more than half of the world’s top banks have invested in blockchain and virtual currency start-ups, and compared with the hottest ICO period (2017-2018), the total investment amount is more than five times. The distribution of investments is also from early to late stage.

NFT will change all walks of life, the scope of influence is more than FT

Compared with FT (general homogenized tokens, such as Bitcoin), NFT can be used to represent everything in the world, which means that NFT has become a key technology for digitization. Compared to the high complexity of DeFi, even with high transaction fees, NFTs provide a simple blockchain entry for a wider range of users.

The explosion of NFTs in the mainstream market can be attributed to many things, including the simple fact that ease of use will always be more important than the novelty of a financial product. DeFi is not suitable for rapid mass adoption, and the brand economy will be a catalyst for peripheral users to join the blockchain space, and more people will enter this market to educate the public. Thanks to tools like Collab.Land and Discord, the NFT tokenized community opens up a seamless on-ramp to the blockchain.

The tax issue of virtual currency has attracted attention, and the supervision will become more and more strict

The DeFi ecosystem has experienced an unprecedented surge in transaction volume in 2021 as more players enter the market and build more sophisticated financial instruments. Protocols like Uniswap, PancakeSwap, and SushiSwap generated more than $100 million in annual revenue last year.

2021 has proven to be the most pivotal year in DeFi and crypto regulatory news to date: including FATF guidelines, Wyoming’s Decentralized Autonomous Organization (DAO) Act taking effect, OFAC’s first enforcement of sanctions against virtual currency exchanges, SEC The SEC will begin taxing virtual currencies (infrastructure bill) through bitcoin futures ETFs and the IRS.

It is expected that this trend will continue, regulations will become more and more strict, all exchanges that still do not need verification will be required to KYC, and for crypto-friendly countries such as: Dubai, Bahamas, may become the center of global exchange headquarters hub.

How to maintain the existing user experience and comply with regulations will be a major challenge for the industry.

Multi-chain trend and ecology

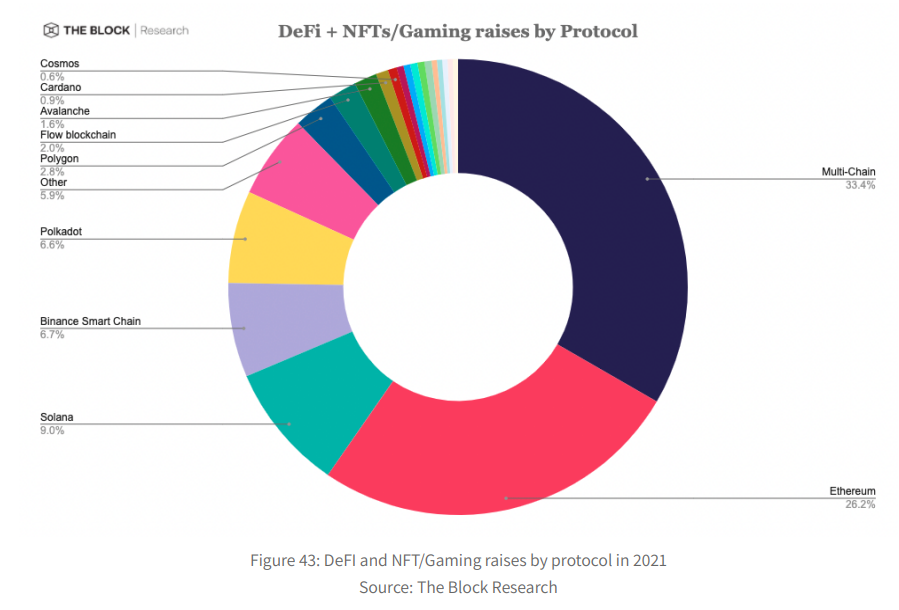

The problem of high transaction fees in Ethereum has made Terra, Avalanche and Layer 2 an alternative for current blockchain applications. As can be seen from the figure below, it is no longer the first choice to raise ETH by issuing tokens. Each block Chains began to develop their own ecosystems independently, instead of only having cheaper transaction fees.

The funds on the L1 and L2 chains continue to grow, and the TVL of the cross-chain bridge continues to increase. The funds will initially be scattered across the cross-chain bridges, but as users seek the best liquidity, they will eventually be integrated into several cross-chains with the most depth of cross-chain liquidity. chain bridge.

- Market highlights for the first half of 2022: Ethereum L2, multi-chain L1, old DeFi for recapitalization, new protocols for aggregated liquidity and voting governance.

- Market focus in the second half of 2022: As ESG representative institutions such as banks and sovereign wealth funds suddenly turn bullish on the blockchain and cryptocurrency fields, Ethereum is expected to gain significant attention after transitioning to 2.0.

The whole ecology of NFT + DeFi + GameFi will become a new battlefield

NFTs provide a very simple way for these companies to connect with these young target markets, NFTs will see more integration with DeFi and GameFi this year, NFT-based lending protocols will become popular, NFTs The trend towards financialization will also proliferate. And with the integration of the two-layer solution (ZK-rollup) and the expectation for the future release of ETH 2.0, the performance of blockchain games will be comparable to traditional games.

TheBlockResearch analyzed all DeFi and NFT gaming projects with a total of 836 fundraising records this year. Observe which blockchain protocol support they intend to use. Between DeFi and NFT/gaming projects, about 33% of the funds raised this year intend to support multiple blockchains. Most of these projects are EVM compatible themselves as “multichain”, which means they support Ethereum, its subsequent layer 2 technology, and other compatible layer 1 networks such as Avalanche, BSC.

Conclusion: Web3 is the next-generation web revolution

ARK Invest pointed out that with consumers spending more time and resources online today, and as consumer spending shifts to the virtual world, the importance of digital assets is likely to increase substantially, and global frameworks like NFTs provide a stable The ownership and control of digital assets can be taken away from the company for the benefit of individuals.

- NFT continues to expand, developing mature business models in entertainment industries such as music and sports.

- NFTs and Metaverse Tokens welcome the boom again and connect with celebrities and fans.

- NFT jumped out of the JPG framework, and well-known brands began to maintain and improve user loyalty through NFT.

- Web2 tries to launch Web3 product and Web2 VCs/Investors start getting involved in cryptocurrencies.

ARK Invest predicts that by 2030, Web3 will reduce annual offline consumption by 7.3 trillion US dollars, and promote online spending to grow at an annual growth rate of 28%. trillion dollars.

The Metaverse is characterized by explosive growth and constant innovation. Web3 is still in its infancy, with a lot of asymmetrical investment opportunities, and it’s worth investing in to start exploring this new digital world for yourself.